Budgetary planning and control

- Planning and control are major activities of managemnt in all organizations.

- Budgets are central to the process of planning and control.

Budgeting

- Allocation of economic resources by an entity to run its business activities and processes to achieve ultimate objectives of entity.

- Defined as quantified plan relating to a given perod

Purpose of budgeting is to

- Provide a forecast of revenes and expenditures

Example

Build a model of how our business might perform financially speaking if certain strategies, events and plans are implemented.

- Enable the acutal financial operation of the business to be measured against the forecast

Example

Sales managers forecasted revenues of $100,000 for this year, and the actual revenues were $90,000. The sales managers can analyse the reasons of variances between the actual and the forecast.

Types of Budgeting Approaches

- Incremental budgeting (IB)

- Zero-based budgeting(ZBB)

- Beyond budgeting (BB)

- Activity-based budgeting (ABB)

1. Incrementa budgeting

Example

The actual budget for purchase department was $100,000 in Year 2021 annnd the estimated budget for purchase department in Year 2022 is projected to increase to $110,000 with considering inflation rate of 10%

- This starts with the previous period's budget or actual results and add (or subtracts) an incremental amount to cover inflation and other known changes

- This budgeting approach is suitable for stable businesses, where costs are not expected to change significantly

- There shoud be good cost standardlization and limited discretionary costs

- This is not for the purpose of cost control because of *budgetary slack

*Budgetary slack

- Budget inefficiency and waste,

- Practice of overestimating the expenses and underestimating the projected revenues when preparing a budget statement for the next financial period.

- Managers would do this to make favourable outcomes on budget so that it is easy to achieve.

| Pros | Cons |

| It is easy to prepare and is therefore quick. | NO incentive for managers to try and reduce costs |

| It is also easily allocated to more junior members of staff | Manager may end up spending all given budget just for protecting for their self-interest (next year budget) |

| Less preparaton time leads to lower preparation costs | Budgetary slacks / NO cost control analysis |

| Prevents conflicts between department managers because of a consistent approach | Current activities and costs are NOT jusitifed at all |

2. Zero-based budgeting (ZBB)

This is suitable for

- Allocating resources in areas were spend is discretionary, for example, non-essential such as R&D, advertising and training.

- This does not determine the possible profitability of the business

- Public sector organizations such as local authorities.

- Fast-changing industry

Example

The actual budget for purchase department was $100,000 in Year 2021 and bugeting process for purchase department for Year 2022 starts with zero(0) and managers find out activities and its costs to be justified for allocation of economic resources.

- NO reference to the prior period's budget or actual budget.

- Based on efficiency & necessity rather than the budget history.

- This aims to achieve an optimal allocation of resources to the parts of the business where they are most needed.

- Managers justfy every activity and its costs in their departments.

- Each cost element to be specifically justified

- The management is constantly keeping their attitudes of scepticism to reasonableness of activity and its costs

- Without approval, the budget allowance is "zero"

Stages in ZBB

1. Decision package

- Activities are identified by managers

- Consider different ways of performing the activities

- These activities are then described as decision package

Under this stage 1, such activities are carried out:

- Analyze the cost of the activity

- States its purpose

- Identifies alternative methods of achieving the same purpose

- Establishes performance measures for the activity

- Assesses the consequence of NOT perofrming the activity of all or of performing it at different level

※ The decision package may be prepared at the base level, representing the minimum level of service or support needed to achieve the organizaton's objectvies. Further incremental packages may then be prepared to reflect a higher level of service or support.

2. Priorization

Management will then rank all the packages in the order of decreasing benefits to the organization.This will help management decide what to spend and where to spend it

3. Resource allocation

The resources are then allocated based on order of priority up to the spending level.

Pros

- It encourages a bottom-up approach to budgeting

- Encourage motivation of employee

- Inefficient and outdated actvite are removed

- Wasteful spending is curbed

- Responds to changes in the business environment from one year to the next

- More efficient allocation of resources

Cons

- Managers may not have the necessary skills to build decision packages. They need training for this, and traing takes time and money

- In a large organization, the number of activities will be so large that the amount of paperwork generated from ZBB will be unmanageable

- Ranking the packages can be difficult since many activities cannot be compared on the basis of purely quantitiative meausres. Qualitative factors need to be incorporated but this is difficult.

- Top managemnt may not have the time or knowledge ro rank what could be thousands of packages.

- Managmeent information system might be unable to provide the necessary information

- Since decisions are made at budget time, maangers may not feel unable to react to changes that occur during the year. This could have a detrimental effect on the business if it fails to react to emerging opportuntiies and threats.

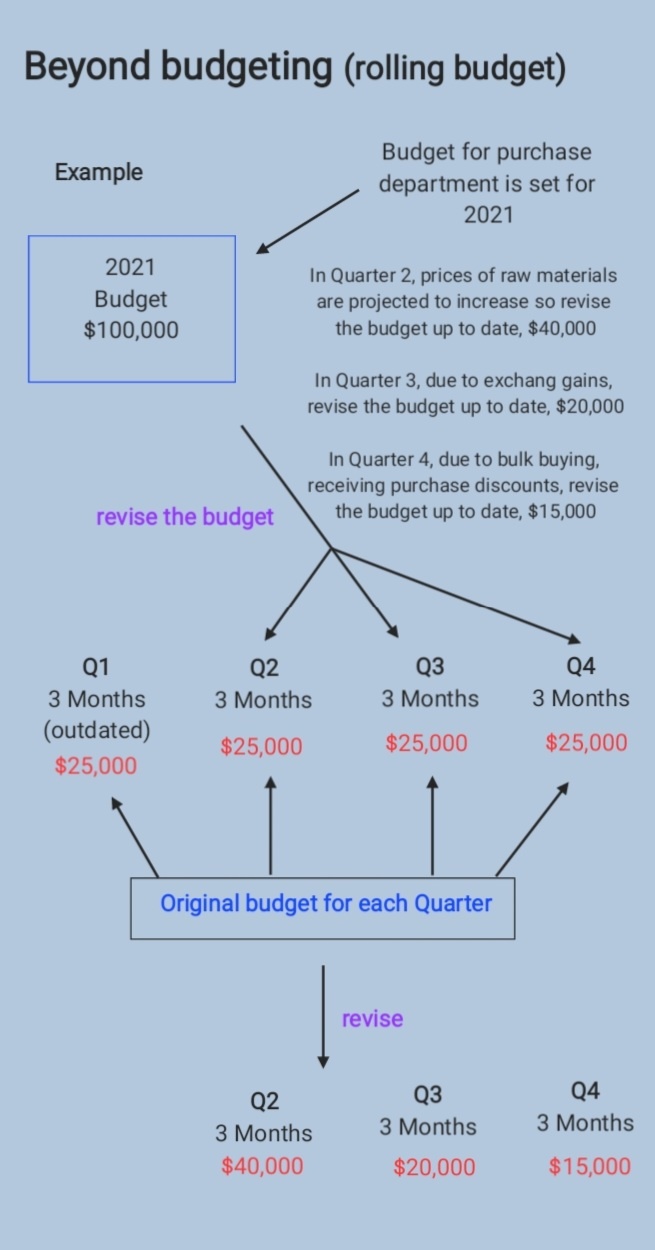

3. Beyond budgeting (BB)

- This is known as rolling budget

- Adaptive to future situation

- This type budgeting is opposed to traditional annual budgeting that it once sets and never changes

- Rolling budgets, produced on a quarterly or monthly basis

- Flexible, do not rely on outdated figures and should result in more timely allocation of resources.

- Allow operational managers to react to the environment

- Focus efforts on managing future results and not explaining past performance

- Modern companies are moving away from traditional, top-down, commandand control cultures and strucutres. These organizations are becoming more decnetralized and agile to stay competive and are using approaches such as Balance Scorecards, ERP systems, and business process re-enginerring to help them achieve this.

- Encourage a culture of innovation

- Innovation and beating the competiion to market with new products are new critical success factors for these companies

Example

Advantages of Beyond Budgeting

1. Faster response

- Giving managers more authority to act immediately within clear strategic boundaries and allowing them to more quickly meet customer needs.

- Bureaucracy is highly discouraged and managers can react quickly to new threats and opportunities instead of being force to follow to an outdated, annual plan.

2. More innovative strategies

- Rewards go to teams and are based on relative performance versus peers, rather than individual incentive based on fixed targets

- Open and self-managed environment is promted, rather than a culture of sticking to a set of rules

- This enable empowered teams, continuous imporvement and innovation

3. Lower costs

- Under the traditional budgeting approach, managers might be motivated to spend everything in given budget. This is because managers will not get it next year. (Protecting costs, rather than controlling or reducing costs)

- Beyond budgeting, manager no longer see the budget as an entitlement to spend, but rather as a scarce resource that should only be used when it adds value to the customer

4. More loyal customers

- Put customer value at the core of their strategy

- Adopt their processes to satisfy and delight them

4. Activity based budgeting (ABB)

- ABB is defined as "a method of budgeting based on an activity framework and utilitizing cost driver data in the budget-setting and variance feedback processes'

- Align activities with objectives, streamlines costs and improve business practices.

- It help to know the potential profitability of the company

Pros

- ABB helps to align value-added activities with objetives, reducing costs in the process

- Resource allocation is linked to strategic plan for the future

- More focus on efficiency and effecrtiveness of alternative methods by which they may be achieved

- Through ABB, it helps the management to identify any activities which are value added that will deliver quality and benefits to the customers.

Cons

- Employee resistance, requiring much effort and time, for example identify all significant activities in an organzation

- Complex and hard to justify cost of implementation, for example, small business with a narrow range of product lines

'경영 이야기' 카테고리의 다른 글

| [경영전략] BCG Matrix, feat. 시장 성장률 & 상대적 시장 점유율 (0) | 2022.07.28 |

|---|---|

| Financial Performance Measurement (Ratios) (0) | 2022.07.28 |

| [APM 필수지식] Types of Responsibility Centers (0) | 2022.07.28 |

| [APM 필수지식] 공공부문 경영평가 기준, feat. 3Es (0) | 2022.07.22 |