오늘 이야기할 키워드는 기업가치 평가하는 방법에 대해서 이야기해보려고한다. 오늘은 편리를 위해 포스팅을 영어 기반으로 작성해보겠다. 바로 본론으로 들어가보자.

어떤 회사가 다른 회사를 인수합병 할 때 해당 기업의 가치를 평가하여 값을 지불한다. 기본적으로 3가지 접근법으로 나뉜다.

- Asset-based models (자산 기반 모델)

- Market-based models (시장 기반 모델)

- Cash-based models (현금 기반 모델)

1. Asset-based models (자산 기반 모델)

- These models attempt to value the assets that are being acquired as a result of the acquisition.

1.1 NAV (Net asset value)

This values a target company by comparing its assets to its liabiltiies, which gives an estimate of the funds that would be available to the target's shareholders if it entered voluntary liquidation. The lowest value of a target company is when the business is to be liquidated or terminated.

순자산가치평가는 기업의 재무상태표의 순자산을 기초로 시작한다. 인수하려는 회사의 최소가치는 순자산 가치와 같다.

NAV 예시

B co's latest statement of financial position is shown below:

| $m | |

| NCA | 1350 |

| CA | 1030 |

| Total Assets | 2380 |

| Share capital | 240 |

| Retained earnings | 860 |

| Total equity | 1,100 |

| CL | 700 |

| NCL | 580 |

| Total liabilities | 1280 |

| Total equity plus liabilities | 2380 |

NAV (Net asset value) 기반으로 이 회사의 가치는?

총 자산에서 총 부채를 뺀 가치가 회사의 최소가치이다. 그렇다면 이 회사를 인수합병 할 때 최소한 지불해야 하는 비용은 1,100 million부터 시작할 것이다.

2,380 - 1,280 = 1,100m (회사가치)

NAV 기반 가치평가 장점은?

1. 심플하므로 적은 시간과 비용이 든다

2. 상장여부 상관없이 모든 회사의 가치를 평가할때 쓸 수 있다.

NAV 기반 가치평가 단점은?

1. 미래현금흐름을 무시한다.

2. 자발적 청산을 가정하여 일정시점에 장부가액을 기초로한다.

i.e 기계장치가 장부에는 50,000원이라고 기록되어있지만 시장가는 30,000원이다. 장부가액의 신뢰도는 낮다.

3. 회사의 무형자산 가치를 무시한다.

1.2 Book value 'plus'

NAV의 단점을 보완하기 위해 프리미엄을 지불한다. 프리미엄은 해당 기업의 이익을 기반 또는 무형자산을 기반으로 정한다.

무형자산이란?

눈에 보이지는 않지만 기업의 비즈니스 이익창출에 기여하는 자산 예를들어, 시장 점유율, 고객과의 관계, 브랜드, 기술력, 특허, 공급망 구축 등

무형 자산의 가치는 어떻게 구할까?

1. 업계 average expected return을 사용하여 기업의 유형자산 기반 평균 이익을 구한다.

2. 기업의 평균 이익 - 유형자산 기반 평균 이익 = 초과하는 금액 (무형자산이 기여한 가치)

Calculated intangible value (CIV) assesses whether a company is achieving an above-average return on its tangible assets. This figure is then used in determining the present value attributable to intangible assets.

CIV involves the following steps:

(a) estimate the profit that would be expected from an entity's tangible asset base using an industry average expected return

(b) calculate the present value (PV) of any excess profits that have been made in the recent past, using the WACC as the discount factor

CIV example

B co's average pre-tax earnings for the last three years has been $400 million, and its average year end asset base for the last three years has been $2,000 million.

The average (pre-tax) return on tangible assets in this sector has been 12%, corporate income tax is 25% and B co's weighted average cost of capital is estimated to be 10%.

Required:

Using CIV, calculate the value of B co's intangible assets:

1. Estimated the profit that would be expected from an entity's tangible asset base using an industry average expected return

2. Calculate the present value of any excess profis that have been made in the recent past, using the WACC as the discount factor.

Solutions:

1. 12% * $2,000m = $240m

2. Intagible assets = $400 - $240 = $160m (pre-tax excess profit)

After tax excess profit = $160 * 0.75 = $120

(Assuming infinity of future cash flows being generated over time)

$120 / 0.1 = $1,200 million

CIV 평가 방법 단점은?

1. It uses the average industry return on assets as a basis for computing excess returns; the industry average may be distorted by extreme values. (무형자산의 가치를 구할 때 업계 average expected return을 사용한다, 데이터 신뢰성 문제)

2. CIV assumes that past profitability is a sound basis for evaluating the current value of intangibles - this will not be true if, for example, a brand has recently been weakened by a corporate scandal or changes in legislation. (과거 수익성 지표를 가지고 현재의 무형자산 가치를 평가한다, 과거 데이터로 무형자산 가치를 예측하기 어렵다)

3. CIV also assumes that there will be no growth in value of the excess profits being created by intangible assets. (무형자산이 기여하는 future cash flows가 일정하다고 가정한다, 현실성 부족)

2. Market-based models (시장 기반 모델)

- These models use market data to value the acquisiton

A sensible starting point for valuing a listed company is the market value of its shares. If the stock market is efficient the market price will reflect the market's assessment of the company's future cash flows and risk (both business risk and financial risk)

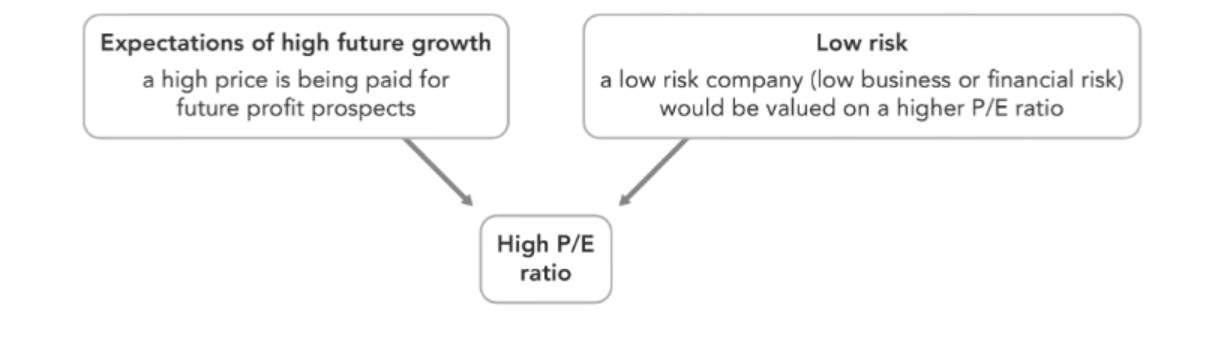

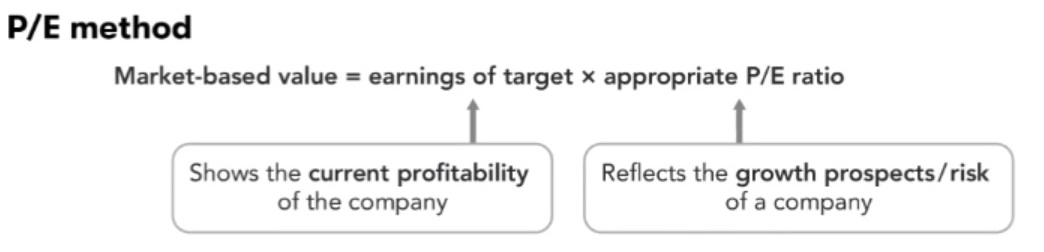

It follows that the relationship between a company's share price and its earning figure, ie its P/E ratio, also indicates the market's assessment of a company or a sector's future cash flows and risk (both business and financial risk)

P/E method 예시

G co wants to acquire an ltalian company, B co which is a company in the same industry. B co's summarized statement of profit or loss for the year ending 31 Dec 20x3. B co's P/E ratio is 16.

| €m |

|

| PBIT | 9.8 |

| Interest expense | 2.3 |

| Taxable profit | 7.5 |

| Taxation(25%) | 1.9 |

| PAT | 5.6 |

| Dividend | 5.0 |

| Retained earnings | 0.6 |

Required:

If G co's P/E is currently 21.2 and it anticipates turning B co around so that it shares G co's growth prospects, calculae the value of B co in €m

P/E method를 사용하여 구한 B co의 회사 가치는?

5.6m * 21.2 = 118.72m

P/E 평가 방법 단점은?

1. 비상장회사의 주식은 상장회사 주식보다 가치가 낮다.

2. Management earning techniques을 사용하여 기업의 순이익을 조작 가능하다.

3. 이 평가 방법은 주식시장이 효율적으로 작동하고 있다는 가정을 기반으로 한다.

4. 다양한 가정 및 판단이 필요하다.정확성, 신뢰성, 실현성 등 고려해야한다.

Post-acquisition P/E valuation

기업이 다른 기업을 인수합병한다면 수익성과 P/E ratio가 변할 것이다.

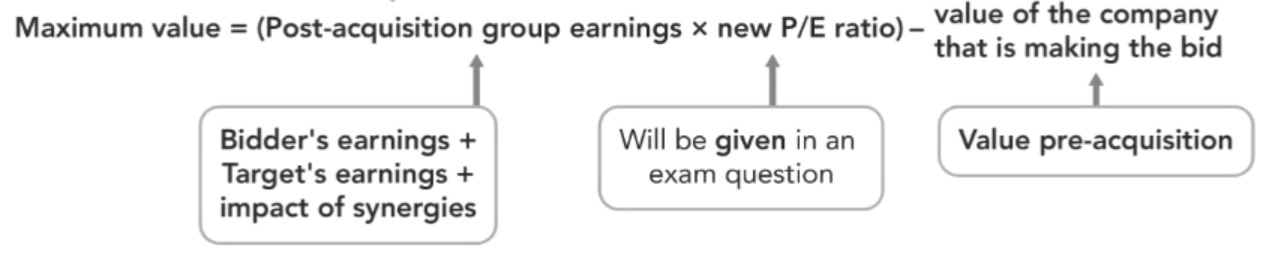

2.1 Maximum to pay for an acquisition (the acquirer가 인수를 위해 지불할 수 있는 최대비용)

The post-acquisition value of the group can be compared to the pre-acquisition value of the bidding company (i.e the acquirer); the difference gives the maximum that the company should pay for the acquisition.

Example

Macleanstein Inc is considering making a bid for 100% of Thomasina Inc's equity capital. Thomasina has a P/E ratio of 14 and earnings of $500 million.

It is expected that $150 million in annual synergy savings will be made as a result of the takeover and the P/E ratio of the combined company is estimated to be 16.

Macleanstein currently has a P/E ratio of 17 and earings of $750 million.

Required:

1. What is the maximum amount that Macleanstein should pay for Thomasina?

2. What is the minimum bid that Thomasina's shareholders should be prepared to accept?

Solutions:

Thomasina equity value prior to acquisition: 14x * $500 = 7,000

Macleanstein equity value prior to acquisition: 17x * $750 = 12,750

Combined company's equity value: ($500 + $150 + $750) * 16 = 22,400

1. 22,400 - 12,750 = $9,650

2. $7,000

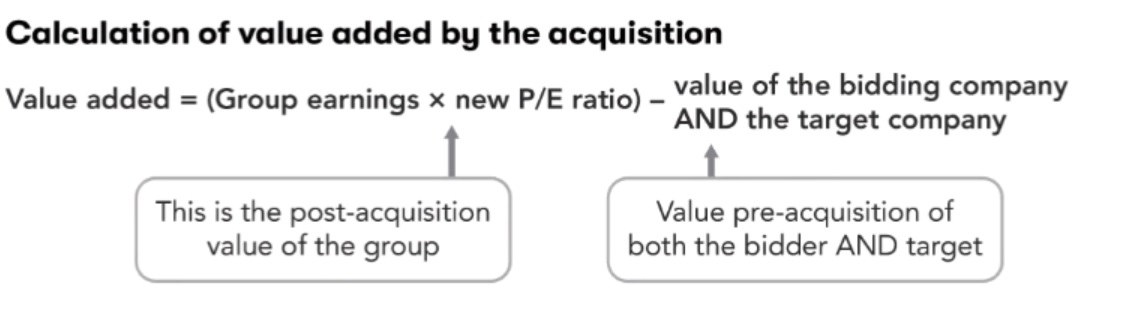

2.2 Calculation of added value created by the acquisition (인수합병으로 인한 시너지)

2.1 문제를 활용하여 인수합병으로 인한 시너지는?

22,400 - (12,750 + 7,000) = 2,650

3. Cash-based models (현금 기반 모델)

- These models are based on a discounted value of the future cash flows relating to an acquisition.

The final set of valuation models are based on the concept of valuing a company using its forecast cash flows discounted at a rate that reflects that company's business and financial risk. These models are often seen as the most elegant and theoretically sound methods of business valuation and can be adopted to deal with acquisitions that change financial or business risk.

3.1 Dividend valuation (Dividend basis)

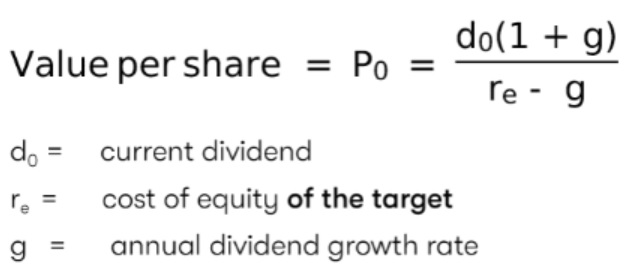

This simplest cash flow valuation model is the dividend valuation model (DVM). This is based on the theory that an equilibrium price for any share is the future expected stream of income from the share discounted at a suitable cost of capital

When using the dividend valuation model to value an unlisted company it may be necessary to use the beta of a similiar listed company to help to calculate a Ke. This beta will need to be ungeared and then regeared to reflect the differences in gearing.

Drawbacks

- It is difficult to estimate future dividend growth

- It creates zero values for zero dividend companies and negatives values for high growth companies (if g is greater than Re)

- It is inaccurate to assume that growth will be constant.

Example

Hitman Co's latest dividend was $5 million. It is estimated to have a cost of equity of 8%.

Required:

Using the DVM to value Hitman Co, asuuming 3% growth for the next three years and 2% growth after this.

Phase 1 (g = 3%)

| Time | 1 | 2 | 3 |

| Dividend $m | 5.15 | 5.3 | 5.46 |

| DF @ 8% | 0.926 | 0.857 | 0.794 |

| PV | 4.77 | 4.54 | 4.34 |

Total = 4.77 + 4.54 + 4.34 = 13.65

Phase 2 (g= 2%)

After year 4 onwards Dividend = (5.46 * 1.02) / 0.08 - 0.02 = 92.82

PV of After year 4 onwards Dividend = 92.82 * 0.794 = 73.70

Total = PV of Phase 1 + PV of Phase 2

13.65 + 73.70 = 87.35

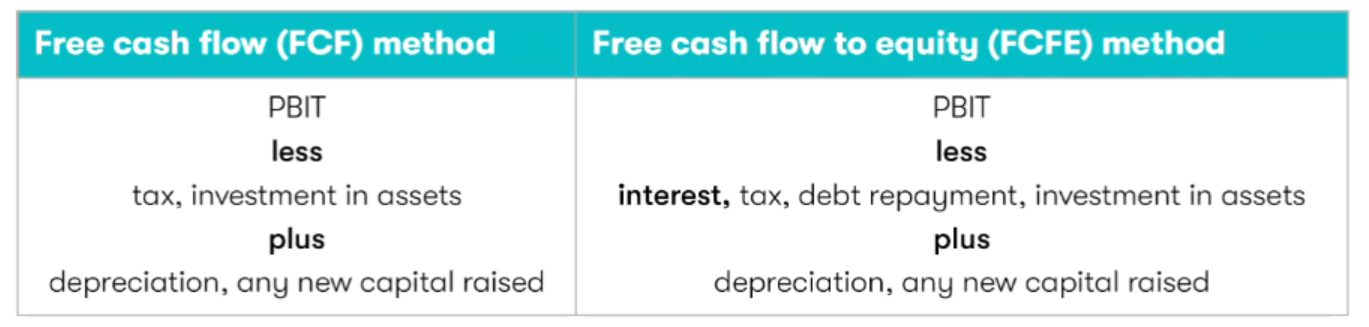

3.2 Free cash flow method (FCF)

The cash available for payment to investors (shareholders and debt holders), also called free cash flow to firm.

3.3 Free cash flow to equity (FCFE)

The cash avaialble for payment to shareholders, also called dividend capacity.

This method can build in the extra cash flows (synergies) resulting from a change in management control, and when the synergies are expected to be received. There are two approaches which can be used.

How to approach for FCF

(a) identify the FCF of the target company (BEFORE interest)

(b) Discount at WACC

(c) This calculates the NPV of the cash flows before allowing for interest payments

(d) Subtract the value of debt from Step 3 to obtain the value of the euqity

How to approach for FCFE

(a) identify the FCFE of the target company (AFTER interest)

(b) Discount at an appropriate cost of equity, Ke

(c) This calculates the NPV of the equity

Example

Wmart Co plans to make a bid for the entire share capital of Ada Co, a company in the same industry. It is expected that a bid of $75 million for the entire share capital of Ada Co will be successful. The acquisition will generate the following after-tax operating cash flows (i.e pre-interest) over the next few years by:

| Year | 1 | 2 | 3 | 4 onwards |

| $m | 5.6 | 7.4 | 8.3 | 12.1 |

Both companies have similar gearing levels of 16.7% (debt as a % of total finance). Ada co has a $15 million bank loan paying a fixed rate of 5.75%. Wmart Co has an equity beta of 2.178, the risk-free rate is 5.75% and the market rate is 10%. Corporation tax is at 30%.

Required:

Assess whether the acquisition will enhance shareholder wealth in Wmart Co. (Use both Approach 1 and Approach 2)

Solution:

FCF approach

Keg: 5.75% * 2.178 (10% - 5.75%) = 15%

Kd (1-tax): 5.75 % (1-0.3) = 4.03%

WACC: (83.3 * 15%) + (16.7% * 4.03%) / (83.3 + 16.7) = 13%

Gearing is 16.3%

Equity = 100 - 16.3 = 83.3%

Phase 1

| 1 | 2 | 3 | |

| Cash flows | 5.6 | 7.4 | 8.3 |

| DF @ 13% | 0.885 | 0.783 | 0.693 |

| PV | 5.0 | 5.8 | 5.8 |

Total PV = 5 + 5.8 + 5.8 = 16.6

Phase 2

Cash flows after 4 onwards: 12.1 / 0.13 = 93.1

PV of Cash flows after 4 onwards: 93.1 * 0.693 = 64.5

Total = Phase 1 + Phase 2

16.6 + 64.5 = 81.1 (total PV of FCF)

Value of equity: 81.1 - 15 (bank loan) = 66.1

FCFE approach

| 1 | 2 | 3 | 4 | |

| Earnings before interest profit | 5.6 | 7.4 | 8.3 | 12.1 |

| Less: post tax interest (15 * 5.75%) * (0.7) |

(0.6) | (0.6) | (0.6) | (0.6) |

| 5.0 | 6.8 | 7.7 | 11.5 | |

| DF@15% | 0.870 | 0.756 | 0.658 | 0.658 |

| PV | 4.4 | 5.1 | 5.1 | 50.5 |

Total PV of FCFE: 65.1 (4.4 + 5.1 + 5.1 + 50.5)

Where an acquisition alters the bidding firm's business ris there is an impact on the existing value of the acquirer as a result of the change in risk, so the following appraoch needs to be used.

STEP 1 Calculate the asset beta of both companies

STEP 2 calculate the average asset beta for the group post-acquisition

STEP 3 Regear the beta to reflect the gearing of the group post-acquistion

STEP 4 Estimate the post-acquisiton value of the group's equity using a cash flow valuation approach

STEP 5 Subtract the existing value of the bidder to determine the maximum value to pay for the target

STEP 6 Subtract the pre-acqusition value of both companies to calculate the value created by the acquisition (i.e the value of the sysnergies)

Example

Salsa Co plans to make a bid for the entire share capital of Enco Co, a company in a different industry. It is expected that a bid of $80 million for the entire share capital of Enco Co will be successful. This will be entirely financed by new debt at 6.8%. After the acquisition the post-tax operating cash flows of Salsa's existing business will be:

| 1 | 2 | 3 | 4 | 5 | |

| $m | 24.12 | 25.57 | 27.1 | 28.72 | 30.45 |

After the acquisition the post-tax operating cash flows of Enco's existing business will be:

| 1 | 2 | 3 | 4 | 5 | |

| $m | 6.06 | 6.30 | 6.56 | 6.84 | 7.13 |

After the acquisition, $6.5 million of land will be sold and there will be synergies of $5 million post-tax p.a. Before the acquisition, Salsa had $45 million of debt finance (costing 5.6% pre-tax) and 40 million shares worth $9m each and an equity beta of 1.19.

As a consequence of the acquisition, the credit rating of Salsa will fall and the interest paid on existing debt will rise by 1.2% to 6.8%.

Enco has an equity beta of 2.2, its existing share price is $1 and it has 62.4 million hsares in issues; it also has $5million of existing debt that woould be taken over by Salsa Co. The risk-free rate is 4.5% and the market rate is 8%; corporation tax s 30%.

Required:

Evaluate the impact on shareholder wealth, assuming that cash flows after year 5 will grow at 2% p.a. (assume that the beta of debt is zero)

Solutions:

W1 Determine asset beta

SALSA

- MVe: 40m * $9 = $360m

- MVd: $45m

ENCO

- MVe: 62.4m * $1 = $62.4

- MVd: $5m

W2 De-gear

- SALSA: 1.19 * 360 / 360 + 45(0.7) = 1.09

- ENCO: 2.2 * 62.4 / 62.4 + 5(0.7) = 2.08

W3 Weighted Asset beta (post-acqu)

(1. 09 * 360) + (2.08 * 62.4) / 360 + 62.4 = 1.24

W4 Regear asset beta

- Post-acq total debt: 45 + 5 + 80 = 130m

- Total equity: 360 + 62.4 = 422.4m

- 1.24 * 422.4 + 130(0.7) / 422.4 = 1.51

- Ke: 4.5% + 1.51 (8%-4.5%) = 9.79%

W5 Post acqu WACC

(422.4 * 9.79%) + (130 * 6.8% * 0.7) / 422.4 + 130 = 8.6%

Post-acqu NPV

| 1 | 2 | 3 | 4 | 5 | After 5 onwards | |

| Cash flows | 35.18 (24.12 + 6.06 +5) |

36.87 | 38.66 | 40.56 | 42.58 | 43.43 |

| Annuity (1 / 0.086 - 0.02) |

15.15 | |||||

| 657.96 | ||||||

| DF@8.6% | 0.921 | 0.848 | 0.781 | 0.719 | 0.662 | 0.662 |

| PV | 32.4 | 31.27 | 30.19 | 29.16 | 28.19 | 435.57 |

Total PV: 32.4 + 31.27 + 30.19 + 29.16 + 28.19 + 435.57 = 586.78 + 6.5 (disposal of land) = 593.28m

Total value of company - total value of debt = total value of equity, 593.28 - 130 (45 + 5 + 80) = 463.28m

What is maximum value to pay for ENCO?

- Value of SALSA BEFORE acqu = 360m

- Max value to pay for: 463.28 - 360 = 103.28m

Current bid price is 80m so still have capacity to increase it.

what is value created by post-acqu?

- Value of group - (value of salsa + value of ENCO)

- 463.28 - (360 + 62.4) = 40.88m

'회계 이야기' 카테고리의 다른 글

| 외부감사가 필요한 근본적인 이유 feat. 사업보고서와 재무제표 (1) | 2022.12.26 |

|---|---|

| [재무관리] 발생가능한 최대손실금액 구하기, feat. VaR (1) | 2022.12.23 |

| [재무관리] 순현재가치, 내부수익률, 수정내부수익률 (2) | 2022.12.17 |

| 금리 스왑(Interest rate swap)의 목적 및 장단점 (2) | 2022.12.16 |